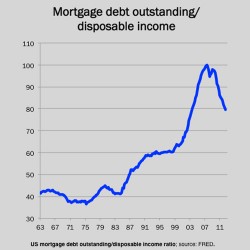

Debt as a national challenge is connected to rampant, unchecked individual debt. I’m not lecturing, I’m just saying. Many households overspend. Many companies run at a loss, year after year. Debt is how you keep the balls in the air. But you can hold them up there only so long.

Debt as a national challenge is connected to rampant, unchecked individual debt. I’m not lecturing, I’m just saying. Many households overspend. Many companies run at a loss, year after year. Debt is how you keep the balls in the air. But you can hold them up there only so long.

The good news is that this is reversible. The very good news is that we will get a handle on our national debt as we dig out of the financial holes we have dug in our homes and our businesses. We get sucked into the debt problem through ignorance. We should learn how to budget and spend and price and do accounting in sixth grade. (I didn’t. Did you?) It’s also tempting to use all that credit that is laid at our feet when we are young and foolish. I created a debt crisis once upon a time. I turned it around, and I love to help others do the same.

Gulp. Do You Tell Your Team?

Recently, as I wrapped up a consulting program, the owner soberly reviewed the balance sheet. We had spent the last few days nailing down the financials, cleaning up the weird entries and verifying the assets, liabilities and equity. Bottom line…for every dollar in assets, he had $2 of debt. Ouch. There is a way out of that hole: Get profitable and take the profits in cash. That involves raising prices, increasing marketing and getting really good at honorable sales and smart operations and production. It takes a disciplined approach to paying debt down and not incurring new debt. It takes a team effort.

“So, do I tell the team about this? About the debt? About…how bad this is?” he asked.

Yes. And, no.

DO…

- Share appropriate information. You don’t need to overshare. Consider sharing Sales and Expense information, Budget Goals and overall debt burden to Managers and those who can impact the numbers with their decisions and behaviors. Start with a few numbers and build up as your team comes up to speed.

- Tell the truth. Whatever you share, share the most accurate information. No padding or making up numbers. This is a powerful way to build trust.

- Give them a way to win if you win. As my mentor Jack Stack says, “Give them a stake in the outcome.” If you win, they win. Find a way to acknowledge and reward Goals achieved and debt reduced. It doesn’t have to be a lot but it should be something.

DON’T…

- Share your personal debt info. Business only.

- Get into details about your IRS or vendor debt negotiations. You don’t need to share who the debtors are. A simple dollar amount of debt you intend to address in the current year is a reasonable bite of information.

- Whine or spread doom and gloom. You can recover from debt. Make it a challenge, a goal! Share the dollar amount of debt that you intend to retire in a year’s time.

- Share if you are going to begrudge them for knowing. Keep it to yourself unless you are willing to engage the team to get it handled and to be in the game together.

That is how you convert debt into wealth. It starts with systems and discipline. The magic comes when you realize it takes a team to make it happen…and the team deserves a piece of the win.